SpaceX IPO 2026: A Trillion-Dollar Catalyst Reshaping the New Space Economy

The SpaceX IPO in 2026 is set to launch the new space economy into unprecedented financial territories.This image is a conceptual illustration and may not represent actual events, data, or entities.

The SpaceX IPO in 2026 is set to launch the new space economy into unprecedented financial territories.This image is a conceptual illustration and may not represent actual events, data, or entities.The global space industry is undergoing a monumental shift, transitioning from a realm of government-led exploration to a vibrant, commercially-driven infrastructure ecosystem. At the heart of this transformative period, as the market rapidly approaches 2026, lies the highly anticipated initial public offering (IPO) of SpaceX. This event is not merely a liquidity moment for Elon Musk and early investors; it is projected to fundamentally redefine valuation benchmarks across the entire aerospace sector and unequivocally signal the maturation of the orbital economy.

The Ascent to a Trillion-Dollar Public Debut

SpaceX's private valuation trajectory serves as a crucial barometer for institutional sentiment concerning the commercial viability of Low Earth Orbit (LEO) satellite constellations and fully reusable heavy-lift launch vehicles. The company's astonishing climb from a $36 billion valuation in March 2020 to approximately $800 billion by late 2025 showcases a remarkable 22-fold increase in under six years [5]. This unprecedented growth is largely underpinned by consistent operational execution and the successful evolution of Starlink into a high-margin cash-flow engine [5].

As of December 2025, SpaceX commanded a secondary market valuation of around $800 billion, fueled by a tender offer priced at $421 per share [4]. This valuation represents a doubling of the company’s enterprise value in just six months, solidifying its position as the most valuable private company in the United States and a primary driver for the broader $1.8 trillion space economy projected by 2035 [1]. Reports suggest the 2026 IPO could aim to raise over $30 billion, targeting an ambitious valuation as high as $1.5 trillion [2]. Such a valuation would place SpaceX among the top 20 largest publicly traded companies globally, valued at roughly half of Tesla, despite generating significantly less revenue—a discrepancy justified by the perceived ‘defensible moat’ of its launch technology and the vast total addressable market (TAM) of global telecommunications [10].

In late 2025, Chief Financial Officer Bret Johnsen oversaw a $2.56 billion secondary share sale, allowing long-term employees and early investors to liquidate holdings at record prices in anticipation of the structural demands of public markets [2]. However, not all institutional maneuvers were without scrutiny. A notable point of friction emerged in late 2025 concerning Baillie Gifford’s investment trusts. The Edinburgh Worldwide Investment Trust (EWI) and US Growth Trust (USA) reportedly reduced their SpaceX holdings in October 2025—a mere two months before the $800 billion revaluation [13]. These trusts sold approximately 35% and 49% of their respective stakes at valuations materially below the December peak, raising questions about institutional transparency and the timing of liquidity events leading up to the 2026 IPO [13]. Such actions highlight the inherent information asymmetry in private space equities, even as the company moves towards the increased transparency required for a public listing.

Proposed Valuation Milestones

- March 2020: $36 Billion (Primary fundraise) [12]

- June 2024: $210 Billion (Secondary tender offer) [5]

- December 2024: $350 Billion ($1.25B Secondary sale) [5]

- July 2025: $400 Billion (Internal valuation event) [1]

- December 2025: $800 Billion (Insider tender offer at $421/share) [1]

- 2026 (Targeted IPO): $1.5 Trillion (Proposed public listing) [2]

The proposed 2026 IPO is characterized by analysts as a 'jumbo' listing, strategically designed to secure the substantial capital required for ambitious infrastructure projects, including 'Moonbase Alpha' and the initial uncrewed missions to Mars [2]. Unlike typical technology IPOs focused on marketing or user acquisition, the SpaceX listing is geared toward funding capital-intensive initiatives such as the construction of space-based data centers and the acquisition of advanced semiconductor hardware for orbital AI inference [2]. Elon Musk, who holds a 44% stake, has reportedly expressed interest in offering priority access or special ownership structures for loyal Tesla shareholders, potentially forging a unique cross-equity ecosystem that integrates his diverse technological ventures [2].

Starlink: The Financial Engine of Global Connectivity

The financial bedrock of the SpaceX IPO is, without a doubt, its Starlink division. Starlink has successfully transitioned from a significant capital expenditure sink to a diversified and robust revenue stream. In 2024, Starlink generated an impressive $7.7 billion in revenue, constituting 58% of SpaceX’s total income [5]. By 2025, this contribution is projected to increase to 70%, driven by a subscriber base that exceeded 9 million active users in December 2025 [5]. This rapid expansion is supported by a constellation of over 9,400 satellites, which now account for approximately 65% of all active orbital assets [14].

Subscriber Dynamics and Revenue Diversification

The accelerating adoption of Starlink is evident in its ability to acquire its most recent million users in just seven weeks, maintaining a cadence of over 20,000 new customers daily [15]. While residential customers form the foundational base, the company has strategically targeted high-ARPU (Average Revenue Per User) segments within the maritime and aviation sectors, where service reliability and continuous connectivity are premium requirements [5].

Starlink's diversified revenue model extends far beyond residential users, tapping into high-ARPU sectors.This image is a conceptual illustration and may not represent actual events, data, or entities.

Starlink's diversified revenue model extends far beyond residential users, tapping into high-ARPU sectors.This image is a conceptual illustration and may not represent actual events, data, or entities.

Despite this impressive growth, the service navigates regional pricing complexities. A standard subscription in the United States remains around $110 per month, yet the company has implemented aggressive pricing in international markets, such as France and Brazil, where rates can be as low as $40 per month. This strategy aims to stimulate adoption in price-sensitive regions and capture the ‘offline’ population, which the ITU estimated at 2.2 billion people globally as of 2025 [18]. Given that terrestrial 5G coverage remains limited in low-income countries (covering only 4% of their populations), Starlink’s LEO infrastructure offers a ‘practical leapfrogging’ opportunity for developing economies [6].

Customer Segment Analysis

- Residential: Est. Annual ARPU: $2,000. Market Characteristics: Mass market, with higher churn potential in urban areas [5].

- Maritime: Est. Annual ARPU: $34,000. Market Characteristics: Critical for yachts, commercial fleets, and global shipping operations [5].

- Aviation: Est. Annual ARPU: $300,000. Market Characteristics: In-flight connectivity contracts with major commercial carriers [5].

- Government/Specialty: Total Est. Annual Revenue: $2.2 Billion. Market Characteristics: Enhanced cybersecurity and dedicated national security links [17].

Direct-to-Cell: The Next Strategic Frontier

A significant revenue catalyst for 2026 is the anticipated commercial maturity of Direct-to-Cell (DTC) technology. By equipping Starlink satellites with eNodeB modems, SpaceX has effectively created the world’s first space-based 4G mobile network that requires no modifications to existing LTE hardware [19]. Strategic partnerships with major carriers like T-Mobile, Rogers, Optus, and KDDI enable SpaceX to leverage existing spectrum assets to eliminate terrestrial ‘dead zones,’ covering over 500,000 square miles in the United States alone [21].

The DTC rollout has followed a carefully phased approach: SMS and location sharing launched in July 2025, followed by limited app-based data for services like WhatsApp and mapping in October 2025 [20]. Full voice integration and global roaming are scheduled for 2026, synchronized with the deployment of larger ‘V3’ satellites launched by the Starship system [19]. For critical users such as maritime crews and first responders, DTC acts as a tertiary ‘safety redundancy layer,’ ensuring connectivity even in the unlikely event of total terrestrial infrastructure failure [20].

Starship: Engineering the Economics of Launch Dominance

The long-term valuation of SpaceX as a trillion-dollar entity is fundamentally predicated on the operational success of Starship, the fully reusable super-heavy-lift launch vehicle. Starship’s primary economic function is the dramatic reduction of the cost per kilogram to orbit—a metric that analysts widely regard as the ‘holy grail’ of space commerce [22]. As of October 2025, the program had completed 11 integrated flight tests, demonstrating critical capabilities such as the ‘Mechazilla’ booster recovery and achieving soft-touchdowns for the upper stage [16].

The Logistics of Reusability and Launch Costs

While the Falcon 9 currently offers the most competitive launch prices in the industry at approximately $2,720 per kilogram, Starship is explicitly designed to lower this metric to double digits [22]. The financial implications of a fully reusable vehicle with a 150-ton capacity are profound: it enables the deployment of massive satellite constellations or heavy industrial equipment at a mere fraction of the cost associated with traditional expendable rockets [22].

Comparative Launch Costs (Internal Cost/kg to LEO)

- Electron: 0.3 Tons Payload, Est. Cost per Launch: $7.5 Million, Est. Internal Cost/kg: $19,039 [26]

- Falcon 9: 17.5 Tons Payload, Est. Cost per Launch: $67 Million, Est. Internal Cost/kg: $3,828 [22]

- Falcon Heavy: 63.8 Tons Payload, Est. Cost per Launch: $97 Million, Est. Internal Cost/kg: $1,500 [22]

- New Glenn: 45.0 Tons Payload, Est. Cost per Launch: Private, Proj. Competitive [27]

- Starship: 150.0 Tons Payload, Est. Cost per Launch: $2 - $10 Million, Est. Internal Cost/kg: $13 - $66 [22]

Despite optimistic internal projections of $2 million per launch, industry skeptics contend that maintenance and refurbishment costs will likely keep the public price point closer to $100–$200 per kilogram in the near term [23]. However, even at these higher estimates, Starship would effectively marginalize every other launch provider globally, establishing a functional monopsony in the heavy-lift market that substantiates the IPO’s aggressive valuation [23].

The 2026 Operational Manifest

The year 2026 represents a critical juncture for Starship’s development. Internal company documents indicate a requirement for the first orbital refueling demonstration in June 2026, a complex procedure where a tanker Starship transfers cryogenic propellant to a target vehicle [25]. This capability is absolutely essential for NASA’s Artemis III mission, which necessitates up to 12 refueling flights to propel a lunar lander to the Moon’s surface [25]. Furthermore, Elon Musk has targeted the 2026 Mars transfer window for the first uncrewed Starship landing on the Red Planet [2]. Achieving these ambitious goals will require a launch cadence of up to four missions per month from Starbase and Kennedy Space Center—a feat heavily dependent on the efficiency of FAA regulatory reviews and continuous hardware iteration [30].

Space-Based Data Centers and the AI Intersection

A core tenet of the ‘New Space’ thesis for 2026 is the expansion into orbital computing. SpaceX has reportedly advanced plans for space-based data centers, an initiative designed to circumvent the severe cooling and energy constraints currently plaguing terrestrial AI infrastructure [2]. This ambitious undertaking, dubbed Project ‘Heart of the Galaxy,’ seeks to seamlessly integrate the high-performance computing needs of xAI with the orbital infrastructure of Starlink [3].

The Thermodynamic Advantage of Orbital Compute

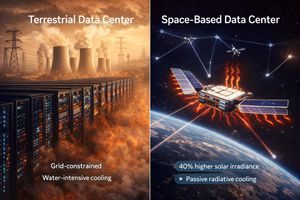

Traditional data centers are increasingly hampered by power grid capacity limitations and the immense water requirements for cooling [8]. In orbit, the advantages are primarily thermodynamic and energy-based. Solar irradiance is approximately 40% higher than on Earth, providing 24/7 unfiltered energy to satellites in sun-synchronous orbits [9]. Cooling, which can consume up to 40% of the energy budget for terrestrial centers, is achieved in space via passive radiative heat dissipation towards the 3-Kelvin background of deep space [9].

Space-based data centers offer significant thermodynamic and energy advantages for next-generation AI computing.This image is a conceptual illustration and may not represent actual events, data, or entities.

Space-based data centers offer significant thermodynamic and energy advantages for next-generation AI computing.This image is a conceptual illustration and may not represent actual events, data, or entities.

Comparative Data Center Parameters

- Energy Density: Terrestrial: Grid-constrained. Space-Based: 1.4 GW per sq. km solar [24].

- Cooling Mechanism: Terrestrial: Water/Forced Air. Space-Based: Radiative heat dissipation [9].

- Latency Link: Terrestrial: Terrestrial Fiber. Space-Based: Optical Laser Interlinks (40% faster) [9].

- Energy Cost: Terrestrial: $0.07 - $0.15/kWh. Space-Based (Proj.): $0.005 - $0.01/kWh [24].

Senior technology investors, such as Gavin Baker, contend that space-based data centers are poised to become the most significant technological breakthrough of the late 2020s [29]. Proof-of-concept missions, including the 2025 launch of a satellite carrying a high-performance Nvidia GPU by startup Starcloud, have already validated the feasibility of running AI inference workloads in the vacuum of space [8]. For SpaceX, this initiative signifies a strategic pivot from being a mere transport provider to evolving into a vertically integrated compute platform, where the company controls power generation (solar), transport (Starship), connectivity (lasers), and cooling infrastructure [9].

Competitive Dynamics: The New Space Prime Contenders

While SpaceX undoubtedly dominates the narrative, the 2026 IPO is expected to elevate the valuations of a burgeoning ecosystem of ‘New Space Primes.’ The competitive landscape is characterized by a division between high-cadence small-launch providers and heavy-lift challengers, frequently backed by billionaire capital [3].

Rocket Lab and the Medium-Lift Challenge

Rocket Lab has firmly established itself as the primary publicly traded alternative for space investors, reporting record quarterly revenue of $155 million in Q3 2025 [32]. The company has strategically focused on a ‘space systems’ approach, not only launching satellites but also manufacturing components and sensors for next-generation defense programs [32].

Rocket Lab Key Metrics (Q3 2025)

- Revenue: $155 Million (48% Year-on-Year growth) [32].

- GAAP Gross Margin: 37% (Record margin for the company) [32].

- Backlog: Record High (Driven by 17 Electron contracts in Q3) [32].

- Liquidity: $1+ Billion (Post-ATM offering to fund M&A) [32].

The development of the Neutron rocket is paramount for Rocket Lab’s 2026 outlook. Neutron is designed to directly compete with Falcon 9 for medium-lift commercial and national security missions, providing a redundant launch option for customers wary of SpaceX’s expanding market dominance [31].

Blue Origin and the Heavy-Lift Rivalry

Blue Origin, after years of perceived sluggishness, achieved significant operational maturity in late 2025 with the New Glenn rocket. The successful landing of the GS1 booster on the sea platform Jacklyn in November 2025 marked Blue Origin as the only other entity to successfully recover an orbital-class booster [28]. With Jeff Bezos personally investing over $10 billion into the firm, Blue Origin is positioned as a ‘measured’ competitor, prioritizing reliability and predictability over SpaceX’s ‘fail-fast’ iteration approach [28].

New Glenn is already under contract for 12 launches to support Amazon’s Project Kuiper, a direct competitor to Starlink [33]. Furthermore, the U.S. Space Force has awarded Blue Origin seven NSSL missions valued at $2.3 billion, signaling the Pentagon’s clear desire for a competitive launch market to ensure ‘assured access to space’ [28]. The 2026 rivalry between Starship and New Glenn is expected to heavily influence the pricing power of heavy-lift services for the remainder of the decade.

National Security and the Geopolitical Space Race

Space has been formally recognized as a strategic domain alongside land, sea, and air, leading to a significant surge in government spending [35]. The U.S. Space Force budget now surpasses $30 billion annually, with a substantial portion allocated to the National Security Space Launch (NSSL) program [35]. In April 2025, the Space Force selected SpaceX, ULA, and Blue Origin to execute a total of 54 Phase 3 Lane 2 missions through 2032, with an estimated worth of $13.7 billion [36].

NSSL Phase 3 Contract Distribution

The distribution of launch contracts underscores the Pentagon’s reliance on SpaceX’s high-cadence Falcon Heavy system for high-value national security payloads [37].

- USSF-206: Provider: SpaceX, Payload: WGS-12 Encrypted Communications, Award Value: $714M (Part of 5-launch batch) [39].

- NROL-86: Provider: SpaceX, Payload: Classified Spy Satellite, Award Value: Included in batch [38].

- USSF-88: Provider: ULA, Payload: GPS IIIF-4 Satellite, Award Value: $428M (Part of 2-launch batch) [39].

- Lane 1: Provider: Open, Payload: Commercial-like missions, Award Value: $5.6B Total pool [36].

SpaceX’s dominance in this sector is further reinforced by its ability to self-fund the development of Starship, whereas competitors frequently depend on government R&D grants [23]. However, the Space Force continues to support ULA’s Vulcan rocket and Blue Origin’s New Glenn to mitigate a ‘single-point-of-failure’ risk in critical national security launch infrastructure [34].

Operational Risks: Debris, Insurance, and the Orbital Tax

The rapid expansion of the LEO environment has introduced systemic risks that could potentially temper the financial outlook for 2026. These risks are quantifiable through the escalating costs of debris mitigation and the inherent volatility of the space insurance market [40].

The Economic Toll of Orbital Debris

NASA and the ESA have increasingly reframed orbital debris not merely as an environmental concern, but as a direct financial risk to invaluable spacecraft assets [41]. The necessity for Collision Avoidance Maneuvers (CAMs) significantly shortens a satellite’s operational life by consuming precious fuel, thereby diminishing its overall return on investment (ROI) [40]. Incorporating essential shielding (e.g., Whipple shields), advanced sensors, and rapid deorbiting systems adds an estimated 5% to 10% to the total mission cost [40].

The insurance market for space assets, valued at approximately $700 million in 2023, has entered a period of crisis. High-value claims, such as the $400 million loss of a single communication satellite, have contributed to an alarming loss ratio of 180% [40]. In response, insurers are tightening coverage for missions operating in congested LEO bands, creating a ‘vicious cycle’ where rising risks drive up operational expenditures, forcing companies to deploy even more satellites to maintain profitability, which in turn further exacerbates congestion [40].

Regulatory and Spectral Bottlenecks

As the number of satellites in LEO is projected to exceed 100,000 by 2030, the traditional ‘first-come, first-served’ approach to spectrum and orbital slot allocation is rapidly becoming a source of geopolitical tension [6]. Developing nations argue that the current regime disproportionately favors established players like SpaceX, potentially transforming space access into a tool of exclusion [6]. Furthermore, terrestrial astronomers have voiced substantial concerns regarding the brightness of satellite constellations, potentially leading to future regulatory mandates for ‘dark’ coatings that could significantly increase satellite manufacturing costs [42].

The 2026 Outlook: A Trillion-Dollar Ecosystem Redefined

The convergence of these profound financial and technical trends strongly suggests that 2026 will stand as the most consequential year for the space industry since the historic Apollo era. The SpaceX IPO will transcend being merely a liquidity event for Elon Musk and his initial investors; it is poised to serve as the definitive ‘valuation anchor’ for an entirely new, investable asset class [11].

Institutional analysts predict that if SpaceX achieves its ambitious $1.5 trillion valuation, it will catalyze a cascading wave of strategic acquisitions and secondary listings for a broad spectrum of satellite data and orbital manufacturing firms [3]. The broader economic implications are staggering. Restoring space investment to levels comparable to the Cold War era could inject an estimated $1.5 trillion to $3 trillion into the U.S. economy over the next two decades [7]. This unprecedented growth is propelled by a fundamental shift in utility: space is no longer solely for observing Earth or exploring distant stars; it has become the new ‘high ground’ for global compute, secure communications, and the foundational infrastructure of the burgeoning AI age [3].

For both retail and institutional investors, the 2026 impact of the SpaceX IPO will be critically measured by the company’s ability to successfully demonstrate Starship’s full reusability and Starlink’s direct-to-cell profitability [10]. Should these ambitious milestones be met, SpaceX will have effectively constructed a ‘digital bridge’ to the remainder of the solar system, transforming the multi-planetary thesis from a dream of science fiction into a quantifiable, investable component of global corporate finance [2].

Disclaimer: This article covers financial topics for informational purposes only. It does not constitute investment advice and should not replace consultation with a licensed financial advisor. Please refer to our full disclaimer for more information.